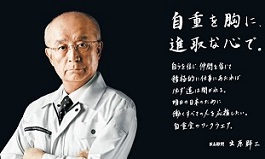

Today I will talk about JICHODO, which was founded in 1924 and manufactures and sells mainly work clothing.

※The above images are from JICHODO’s website

JICHODO is a long-established company that manufactures and sells work clothes worn by factory workers, as well as safety shoes, medical lab coats, and uniforms for the service industry.

Manufacturing is mainly done overseas, and it seems to be primarily sold in online shops and catalogs.

¥5,910(9/4 last closing price)

The latest stock price← click here Trading unit: 100

The final month of the settlement :June

Dividend yield 5.08 %

PER 12.17 PBR 0.53

Equity ratio 83.0 %

The demand for Work clothing is strong, but due to Covid-19, the operation of the outsourcing factory in China was unstable in the previous fiscal year.

It seems that work clothes with enhanced functionality have been developed and aimed at expanding exposure through advertising on social media.

JICHODO has introduced electronic catalogs for sales support of sales agents as well as strengthening its online shopping.

Transition of business results

|

|

Net sales |

Operating profit |

Net profit |

Net profit per share |

dividend |

Dividend payout ratio |

|

2018.6 |

17,359 |

2,904 |

2,224 |

771.6 |

300 |

39% |

|

2019.6 |

19,359 |

2,548 |

1,571 |

545.1 |

300 |

55% |

|

2020.6 |

18,467 |

1,847 |

1,603 |

556.3 |

300 |

54% |

|

2021.6 |

18,250 |

2,175 |

1,550 |

537.7 |

300 |

56% |

※Unit of sales, operating profit, net income is one-million yen

※The figure for June 2021 is the predicted value

|

Cash flow statement |

2020.6 |

2019.6 |

|

CF operating activities |

▲176 |

▲3,899 |

|

CF investing activities |

101 |

▲692 |

|

CF financing activities |

1,630 |

▲872 |

※One unit is one million yen

Note: You should be responsible for your own investment. Please make your own final judgment.