Today I will talk about NISSO PRONITY, an excellent metal processing company, headquartered in Fukuoka Prefecture and listed on the second section of the Tokyo Stock Exchange.

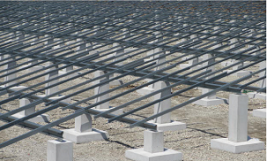

※The above images are from NISSO PRONITY’s website

Generally, many metal processing industries are relatively small scale companies of specialized businesses. NISSO

PRONITY is mainly engaged in metal processing for building materials and is a so-called family-run company that performs various types of processing such as cutting, pressing, molding, and bending.

It is headquartered in a rural area, plain and unnoticeable, but has high technical capabilities,making it my favorite kind of company.

¥547(5/18 last closing price) The latest stock price← click here Trading unit: 100

The final month of the settlement: August

Dividend yield 4.57%

PER 9.76 PBR0.38

Equity ratio 70.5%

The products of NISSO PRONITY have a high added value so that compared with the general manufacturing industry, NISSO performs at a high operating profit margin, However the increase or decrease in orders for pillars of mega solar will have a significant impact on its sales.

Through mergers and acquisitions, it is expanding its field of activity to peripheral business, not only metal processing but also rubber processing.

Unlike many other listed companies, since this company’s majority shareholder and the manager are the same, I believe it has the advantage of quick decision-making and mobility.

In addition, considering the recent recession due to Covid-19, it is also attractive because this company has enough cash.

Transition of business results

|

|

Net sales |

Operating profit |

Net profit |

Net profit per share |

dividend |

Dividend payout ratio |

|

2017.8 |

6,372 |

915 |

624 |

87.9 |

25 |

28% |

|

2018.8 |

8,523 |

1,082 |

824 |

128.4 |

30 |

23% |

|

2019.8 |

13,473 |

1,954 |

1,309 |

203.8 |

30 |

15% |

|

2020.8 |

8,000 |

550 |

350 |

56.0 |

25 |

45% |

※Unit of sales, operating profit, net income is one-million yen

※The figure for August 2020 is the predicted value

|

Cash flow statement |

2019.8 |

2018.8 |

|

CF operating activities |

1,556 |

▲946 |

|

CF investing activities |

▲128 |

282 |

|

CF financing activities |

381 |

235 |

※One unit is one million yen

Note: You should be responsible for your own investment. Please make your own final judgment.