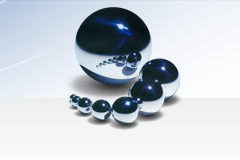

Today I will talk about the automobile and machine parts manufacturer TSUBAKI NAKASHIMA, which manufactures precision balls mainly used for bearings.

※The above images are from TSUBAKI NAKASHIMA’s website

Bearings with built-in steel balls solve friction in rotating parts of automobiles, motorcycles,

computers, machine tools, etc. which require semi-permanent durability.

High-precision rotation technology is generated from the technology to produce a smoother, more nearly perfect sphere , TSUBAKI NAKASHIMA boasts a high level of technology in the accuracy of steel balls, and accounts for about 30% of the

world market.

¥1,691 (9/13 last closing price) The latest stock price← click here Trading unit: 100

The final month of the settlement: December Dividend yield 4.79% PER 8.47 PBR1.53

Equity ratio 32.5%

The main product, precision steel balls, has been declining for European and Chinese automobiles, but demand for machine tools seems to be solid.

Improving production efficiency through automation seems to be the key to increase operating profit.

Transition of business results

|

|

Net sales |

Operating profit |

Net profit |

Net profit per share |

dividend |

Dividend payout ratio |

|

2016.12 |

36,886 |

6,922 |

4,632 |

116.5 |

63 |

54% |

|

2017.12 |

53,244 |

6,985 |

3,176 |

80.2 |

64 |

80% |

|

2018.12 |

74,832 |

9,942 |

6,819 |

171.5 |

79 |

46% |

|

2019.12 |

75,500 |

11,000 |

7,150 |

177.8 |

81 |

46% |

※Unit of sales, operating profit, net income is one-million yen

※The figure for December 2019 is the predicted value

|

Cash flow statement |

2018.12 |

2017.12 |

|

CF operating activities |

81 |

51 |

|

CF investing activities |

▲33 |

▲438 |

|

CF financing activities |

▲31 |

316 |

※One unit is one hundred million yen

Note: You should be responsible for your own investment. Please make your own final judgment.