It was a difficult year for many individual investors who invested in Japanese stocks in 2018.

Compared with the beginning of this year, my retained assets of Japanese stocks have decreased by 16.4% as of December 28th (excluding dividends and J-REIT)

In this blog I introduced a few stocks, but the stock prices fell sharply since then as seen below.

(Since investing is an individual’s sole responsibility, please don’t hold me responsible)

|

Company name |

Introduction date |

Stock price on introduction date |

Year-end closing price |

Fluctuation rate |

|

July 24 |

3,538 |

3,001 |

-15.2% |

|

|

JT |

August 7 |

3,101 |

2,616.5 |

-15.6% |

|

September 2 |

1,040 |

880.3 |

-15.4% |

|

|

October 5 |

1,836.5 |

1,605.5 |

-12.6% |

|

|

October 20 |

533 |

527 |

-1.1% |

|

|

November 4 |

1,661 |

1,619 |

-2.5% |

|

|

Tokyo Electron |

November 27 |

15,770 |

12,515 |

-20.6% |

I believe many investors have a hard time with assets decreasing, but I

welcome the bear market rather than going through hardships.

This is because it is a valuable opportunity to buy stocks cheaply in a style that has long-term holding potential while in the meantime receiving dividends.

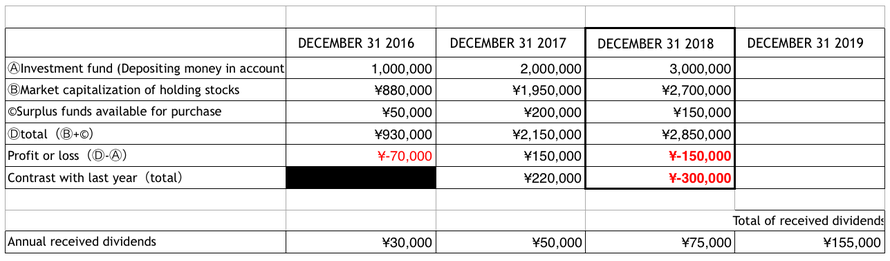

I added an example of an annual operation result table to management method, please use it as a reference if needed.

I hope 2019 will be a good year for everyone!